Complexity Gaming owner GameSquare (NASDAQ:GAME, TSXV:GAME) announced financial results for H1 and Q2 2023 on Tuesday.

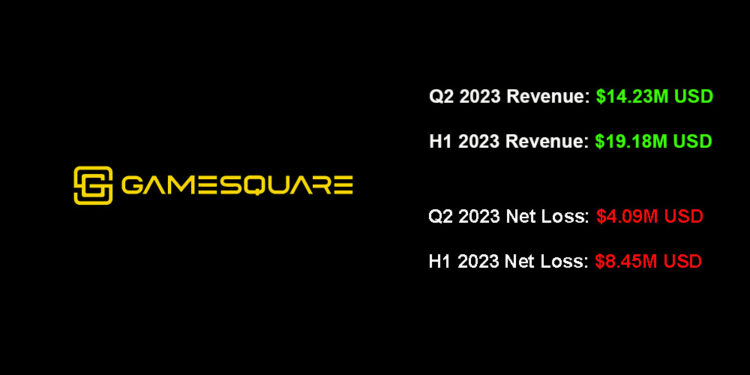

For the second quarter that ended on June 30, the company recorded revenue of $14.23M USD compared to $6.65M for the same period a year ago; a gross margin of $4.06M, compared to $3.01M in Q2 2022; a net loss of $4.09M, compared to a net loss of $2.52M; and an adjusted EBITDA loss of $4.08M, compared to a loss of $1.29M in Q2 2022.

For the first six months of 2023 (H1) that ended on June 30, GameSquare reported revenue of $19.18M, compared to $11.69M in the same period a year ago; gross margin of $5.99M, compared to $4.66M in Q2 2022; a net loss of $8.45M, compared to a net loss of $6.51M; an adjusted EBITDA loss of $6.44M, compared to a loss of $4.03M in Q2 2022.

On a Proforma basis (compared to Q1, which ended on March 31) GameSquare generated revenue of $14.23M, compared to $13.74M in Q1; gross margin of $4.06M, compared to $4.16M in Q1; a net loss of $4.09M, compared to a net loss of $12.25M in Q1; and an adjusted EBITDA loss of $4.08M, compared to a loss of $5.14M in Q1.

GameSquare reported assets of $76.14M, an increase from $20.09M as of Dec. 31, 2022—the company’s current assets included a $4.3M position in cash and restricted cash—and liabilities of $37.31M, compared to $12.94M as of Dec. 31, 2022.

In a release announcing the results, GameSquare CEO Justin Kenna noted that the company completed integration with Engine Gaming (which it merged with in April) and streamlined its cost structure. In addition, Kenna said that the company has removed “an estimated $5 million of annualized operating costs during the quarter and we continue to expect to realize at least $8 million of total annualized cost savings by the end of the year as we drive efficiencies and cost synergies across our business.”

On the second half of the year, Kenna said:

“I am excited by the opportunities we are pursuing as we enter the seasonally strong second half of the year, supported by strong closed revenue quarter-to-date and 60% of annual revenue historically falling in the second half. As a result, we expect sales in the second half to be between $47 million and $52 million, which combined with first-half pro-forma sales of $28 million are expected to produce full-year 2023 pro-forma sales of between $75 and $80 million. We also expect annual gross margin in 2023 to range between 30% and 35%, which combined with additional cost saving actions are expected to help us reach profitability in the fourth quarter.”