In a new guest post, Shikenso Analytics Director of Sales and Marketing Benedikt Becker explains why the recent decline in viewership for the League of Legends Championship Series (LCS) Spring Split weekend wasn’t all bad news for Riot Games—digging beyond the surface level data reveals some interesting facts about the audience watching LCS, its media value, and more.

The recent conclusion of the LCS Spring Split witnessed a new low in the history of the league, with viewership numbers hitting an all-time low. Sunday’s title decider drew an online peak viewership of fewer than 300K people. Many publications have been quick to report on this decline, suggesting that the LCS is losing its relevance in the esports landscape. However, an in-depth analysis of the audience and media value beyond total viewers of the event reveals a different narrative.

An Adult Gen Z Focused Audience

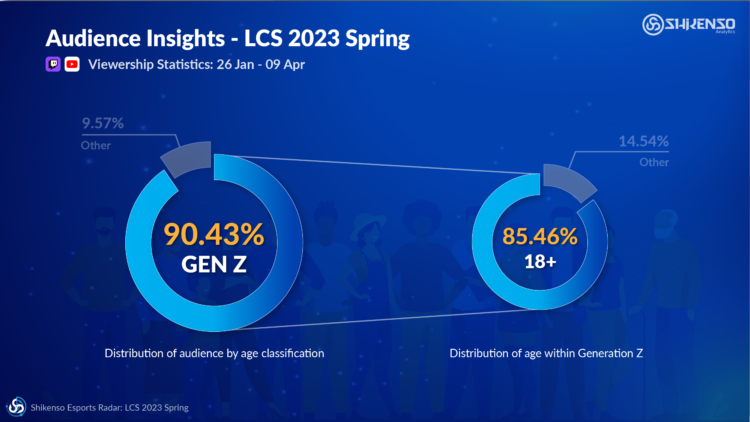

Despite lower viewership, Shikenso’s analysis shows that the LCS Spring Split managed to attract a predominantly Gen Z audience, with 90% of those viewers falling into this demographic. There is still a misconception of esports that only kids and young teenagers enjoy watching it. Data pulled from the Shikenso Esports Radar tells a different story: the LCS Spring Split reaches a mature and influential audience with purchasing power, with the lion’s share taken by 18 – 23 year-old viewers—a target group that many companies nowadays find difficult to reach through traditional marketing efforts. This alone makes the LCS an attractive platform for advertisers and sponsors.

Image Credit: Shikenso Analytics

A Global Fan Base

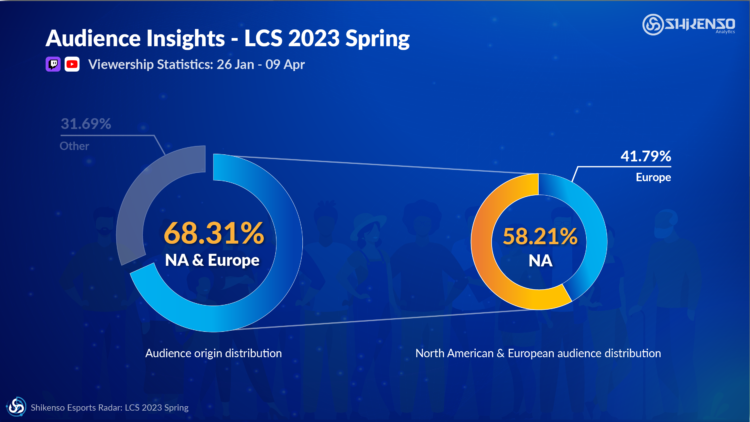

The largest share of viewers for the LCS Spring Split hailed from economically powerful regions such as North America (40.78%) and Europe (27.53%). Comparing these two regions alone, Europe made up for nearly half of the viewers (41.79%), even with night-time broadcasting hours. This, together with the fact that an even bigger portion of the viewership is non-US-based (59.22%) highlights that there is a global appeal for the LCS. Esports fans from around the world have embraced the league format, the participating teams, and the immense production quality provided by the organizer. The global nature of the LCS fanbase is a testament to the league’s ability to transcend regional boundaries and capture the attention of esports enthusiasts worldwide.

What surprised us even more is that most press reports on LCS viewership haven’t mentioned the Easter holiday weekend at all. The finals took place during the holiday weekend, which surely made it more difficult for fans to tune in, both in and outside of the US. Naturally, this had a considerable impact on the league’s viewership.

Despite reported viewership numbers, the league’s ability to captivate a diverse, international audience should not be underestimated.

Image Credit: Shikenso Analytics

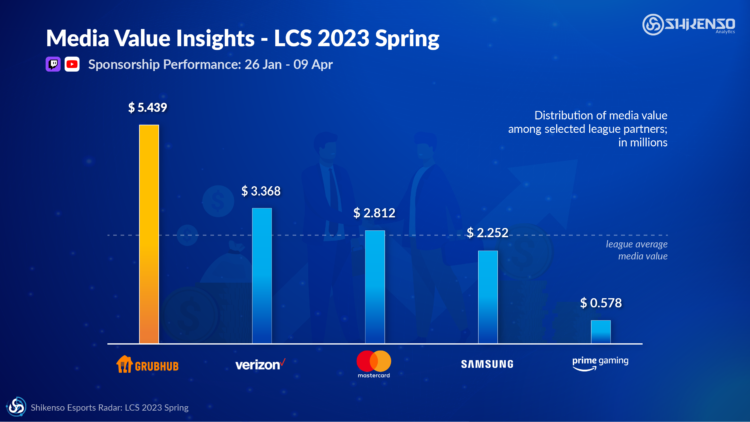

Strong Media Value With Naming Sponsor Grubhub

The data on media value generated by the LCS through partnership exposure reveals that the event has been highly successful in two areas: Firstly, achieving an overall media value that will please all involved parties, with over $22M. Secondly, in promoting its naming sponsor Grubhub in an excellent fashion. In fact, the delivery platform secured nearly double the average media value generated by all sponsors. With an overhauling of 25% of total generated media value, the case of Grubhub demonstrates the effectiveness of the LCS as a platform for brands to increase their visibility and engage with their target audience.

It’s not always the case that a naming sponsor generates such a big chunk of media value. The result clearly indicates the league’s ability to deliver key results for its partners. We believe that the diversity of viewers across financially strong markets is what makes the LCS particularly appealing for global sponsors like Mastercard, Samsung, and Red Bull.

The Impact Beyond Viewership Numbers

Despite the negative publicity that the LCS received, a closer look reveals that the success of the event cannot be measured by one indicator alone. While the event may have experienced a dip in viewership, its true value lies in its ability to attract a mature, Gen Z audience as well as its generated media value. For major brands such as Mastercard, Secretlab, Red Bull, Samsung, Verizon, and Grubhub, it is of fundamental importance to analyze and evaluate the event on a deeper level, as viewership figures do not reflect the whole truth. For the sustainability of esports, it is even more important to look at the figures that actually make a statement about the success of an event.