The Esports Advocate has learned through multiple sources that analytics firm Newzoo is taking a serious step back from analyzing esports industry data. Way back in 2016, Newzoo announced that it had signed a number of partnerships and launched an esports partnership program. TEA has learned that the company quietly sunsetted those programs and ended all of those partnerships at the end of 2022.

Newzoo announced its esports partnership program in October of 2016, initially signing Immortals, Fnatic, G2 Esports, LGD Gaming, and NAVI. Through the program, esports organizations shared revenue and other data with the company to be used to develop its subscribers-only “Esports Audience and Revenue Model” and quarterly “Global Esports Market” reports. Through the years, the company added several other organizations into the mix including Team Liquid, EXCEL Esports, Ninjas in Pyjamas and ESV5 (part of the NIP Group), Team Vitality, Simplicity Esports, Evos Esports, and Guinevere Capital, among others.

Representatives from Team Liquid, G2 Esports, EXCEL Esports, Simplicity Esports, Guinevere Capital (which operates a number of small-scale esports organizations), and LGD Gaming confirmed that they were no longer Newzoo partners.

Sources speaking on background because they were not authorized to speak told TEA that Newzoo will no longer produce dedicated reports related to esports, cloud, or mobile. Instead, these sectors will be relegated to add-on reports, when relevant. Newzoo will continue to track viewership and social media footprint data as it relates to content creators and streamers because investors are still keen on that particular space, but most have moved on from esports to focus on web3 and the metaverse. And while the company won’t focus on esports as a key pillar of its data offerings it will continue to conduct and use research to complement its industry-focused offerings about PC and console gaming going forward.

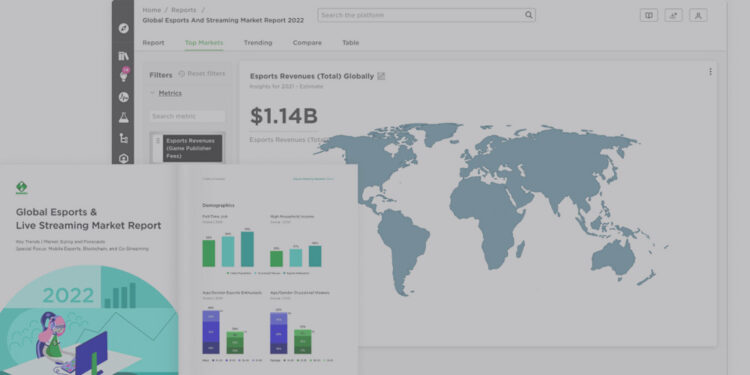

A Newzoo spokesperson confirmed the entirety of our story on Thursday, and issued a statement on why it sunsetted reports dedicated to esports, cloud, and mobile. The company also noted that on Feb. 22, it announced a relaunch of its gaming data products for subscribers, broken up into four key pillars: PC and console game engagement and revenue data (“Game Performance Monitor”), global game consumer survey data (“Global Gamer Study”), games awareness and purchase funnel data (“Game Health Tracker”), and games market forecasts (“Games Market Reports and Forecasts”).

Newzoo issued the following statement exclusively to TEA:

Last year, we made the decision to sunset some of our products, including two of our consumer insights products as well as our Global Esports, Cloud, and Mobile Reports. Our clients, prospects, and partners were informed about this change to our product portfolio last year.

Related to this, we have discontinued updating our Global Esports revenue model. One of the inputs for this model was the financial data we received from our esports partners. Since we discontinued the model, the esports partnership program was no longer necessary and we are not partnered with any esports teams at this point.

Newzoo’s mission is to provide the best tools, data, and guidance to thrive in the games market. For most of our clients, this means helping them to develop, launch, and operate successful games. Last year, we spoke to many clients about how our data adds the most value to their day-to-day work and decision making. From these conversations, it became clear that we can add the most value by providing game-level engagement and revenue data, gamer research, and games market trends and forecasts. On the report side specifically, most of our clients would normally look at cloud, esports, mobile as part of their whole games market strategy which led us to consolidate these insights into our long-standing global games market report.

Consolidating these products has allowed us to invest more resources into the data that adds the most value to our clients. As part of this, we have been investing heavily in the Newzoo platform, which we relaunched last week with added functionality.

We want to accelerate the future of gaming and we believe that it is very much tied to the future of media and entertainment. Based on this, we have created new segmentations around media platforms and entertainment types that take consumer engagement as the starting point and help to put games in a broader perspective. These insights are available in the attached report.

This news isn’t particularly new or noteworthy for anyone that works closely with the company; most of the organizations TEA spoke to this week acknowledged that Newzoo walking away from the esports segment was widely known in industry circles as early as Q3 of 2022.

Hongyu Chen and Biff Corbett contributed to this report.

Full Disclosure: Hongyu Chen and James Fudge are former employees of The Esports Observer and Sports Business Journal—both owned by Advance Publications, Inc., which also owns Newzoo.