Credit: Faze Clan

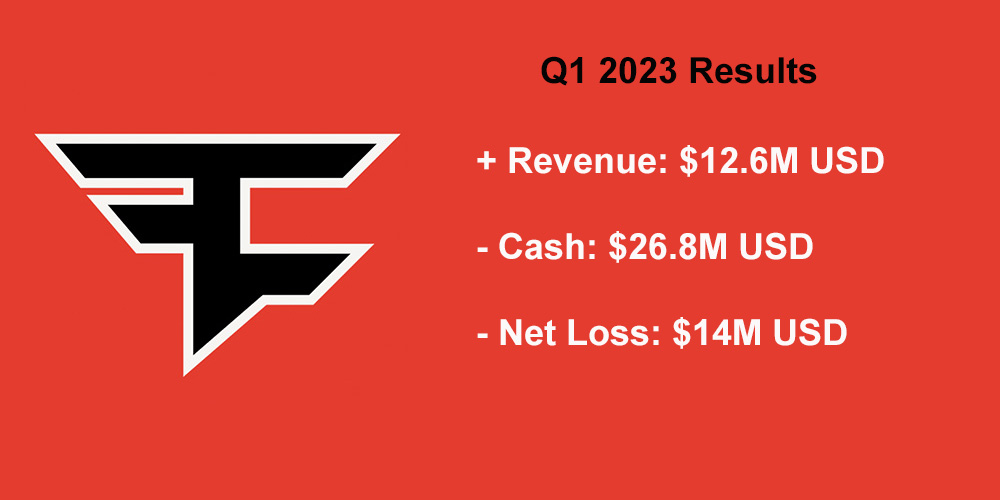

FaZe Clan continues to burn through its cash reserves while the company is trying to make its “strategy of driving brand sponsorships, enhancing our talent network, and managing our costs” work. The Nasdaq-listed esports, gaming, and lifestyle organization ended the first quarter of 2023 with a cash position of $26.83M USD ($27.4M in cash and equivalents), a position that is significantly smaller than FaZe’s $37.21M cash position at the end of Q1 2022 before the company went public and received $57.8M in net proceeds in the process.

In the three-month period that ended March 31, FaZe Clan generated $12.55M in revenues “driven by brand partnerships and esports as well as our continued efforts to streamline the business,” said the company’s CEO Lee Trink. Compared to the same period in 2022, revenues decreased by 20.6% from $15.8M. FaZe Clan determined that the decrease was primarily caused by the slowing of its brand sponsorship and content businesses. Additionally, the first quarter of 2022, saw “unusually high revenues due to a one-off library deal for the content of one of our talent, and a high-budget, high-revenue content strategy, which the company ultimately abandoned.”

Brand sponsorships contributed roughly half of FaZe Clan’s revenues for the period as the company had nine (9) sponsors that have a contractual value of at least $500K under contract and signed German automotive brand Porsche as a new partner during the period. Nevertheless, the money generated from brand sponsorships decreased from $8.06M in Q1 2022 to $6.26M in Q1 2023 “due to the timing of the execution of new sponsorship deals.” The company’s content business revenues also declined year-over-year from $4.68M last year to $3.03M. FaZe Clan’s esports business on the other hand was able to grow revenues by 17.3% year-over-year to $2.85M in the quarter that saw FaZe Clan’s CS:GO team win the Intel Grand Slam, Atlanta FaZe winning the Call of Duty Major II in Boston, and FaZe Clan entering the newly established sim racing competition ESL R1.

While FaZe’s revenues decreased, its relative cost of revenues increased to 96.3%, compared to 77.3% in Q1 2022. As a result, the company’s gross profit dropped by 86.9% from $3.59M in Q1 2022 to $469K in Q1 2023. Additionally, operating expenses increased by $2.82M year-over-year to $14.09M due to “increased costs in compensation and benefits, stock compensation expense, and professional services fees as a result of the growth of the business and of becoming a public company.” As a result, FaZe Clan ended the first quarter of 2023 with a net loss of $14.04M compared to a $9.54M net loss in the same period of last year.

FaZe Clan anticipates continuing to operate unprofitably in the development of its business, therefore, was required to warn investors in its quarterly report that it is incurring significant recurring losses, anticipating further losses, and having negative cash flows – all factors that “raise substantial doubt about [FaZe Clan’s] ability to continue as a going concern.” However, FaZe Clan also outlined that based on its cash resources at the end of the quarter, it believes it has sufficient resources to stay in business for at least another year.

Addressing its financial situation, FaZe Clan shared with its investors that its “Board of Directors is also highly engaged in assessing various options regarding FaZe’s capital structure. These discussions could result in a range of outcomes. However, there are no assurances that any of these options will come to pass, and the company is giving no timeline for a decision, if any.”

In addition to its financials, FaZe Clan highlighted several operational key performance indicators (KPIs), specifically, total reach, aggregate YouTube subscribers, average revenue per YouTube subscriber, and the total number of significant sponsors. FaZe Clan’s fanbase was summarized with a social media total reach of more than 509M, which includes the social media profiles of the organization’s members and ambassadors (including channels contributing a total reach of 209M that FaZe is not contractually allowed to directly monetize). Aggregate YouTube subscribers were 132M, average revenue per YouTube subscriber was $0.10 – down from $0.54 in Q1 2022. FaZe Clan also shared that approximately 84% of its audience is between the ages of 13-34.

Riot Games announced Thursday that it recorded record viewership for Valorant Champions Tour Masters Madrid…

International esports organization Gen.G announced Thursday that it has acquired League of Legends-focused data analysis…

The government of Dubai has officially launched the Dubai Program for Gaming 2033, a visa…

Germany-based esports organization Berlin International Gaming (BIG) announced a new partnership Wednesday with software and…

Esports tools and data company Abios announced this week that it has appointed Chief Technology…

International esports tournament organizer BLAST announced this week that global financial technology company Revolut will…